On April 2, President Trump formalized the policy through two executive orders establishing a 10% "minimum baseline tariff" for all trading partners, with supplemental duties up to 34% for Chinese imports (resulting in 54% cumulative tariffs). The policy shockwaves reverberated globally: German automakers experienced immediate stock plunges, Hyundai announced emergency U.S. investment increases, and Chinese manufacturers accelerated production capacity transfers to Southeast Asia and Europe.

While the tariff policy threatens profound impacts on the U.S. domestic automotive industry, no major manufacturing nation remains insulated. Mexico and Canada face economic contraction risks due to deep supply chain integration with the U.S. More fundamentally, the policy signifies a paradigm shift in U.S. economic strategy from conventional trade competition to systemic disruption of global trade frameworks. As Tesla CEO Elon Musk acknowledges that "localization cannot fully offset cost impacts," the credibility of the "manufacturing renaissance" narrative shows increasing fissures.

When geopolitics reduces the benefits of globalization, will cooperation or confrontation prevail?

The new job crises are coming

The tariff policy directly targets major automotive exporters. As the European automotive hub, German manufacturers exhibit acute dependence on the U.S. market, with Volkswagen, BMW, and Mercedes-Benz accounting for 73% of the EU's $38.46 billion automotive exports to America in 2024. Market reactions were immediate: Volkswagen and BMW shares fell 3.1% and 3.7% respectively on policy announcement, while Daimler Truck Holdings plunged 5.8%.

German automotive leaders warn of catastrophic consequences, with the German Automotive Industry Association predicting potential layoffs of 15,000 workers at Volkswagen alone. Critical supply chain integration compounds the crisis - popular models like the BMW X3 and Volkswagen Tiguan, manufactured in Mexican facilities, would incur 25% tariffs when entering the U.S. market.

Japan's automotive sector confronts existential threats, with U.S.-bound exports accounting for 28.3% of total automotive exports and supporting over 5 million jobs. Nomura Securities forecasts a 30% decline in Toyota's operating profits and potential losses for Mazda under tariff implementation. Nissan's operational challenges exemplify the crisis: The automaker has suspended U.S. orders for its QX50 and QX55 models, which constitute 40% of Japanese automakers' Mexican exports to America. Concurrently, Honda is restructuring its supply chain by replacing Japanese-sourced hybrid batteries with Toyota-manufactured U.S. batteries, affecting 400,000 vehicles.

Korean automotive exports face particular vulnerability, with 2024 U.S. exports reaching 34.7billion(49.134.7billion(49.12 billion investment - interpreted as conciliatory overtures to U.S. policymakers. Nevertheless, South Korea's Ministry of Trade, Industry and Energy maintains plans to initiate WTO dispute consultations.

Korean automotive exports face particular vulnerability, with 2024 U.S. exports reaching 34.7billion(49.134.7billion(49.12 billion investment - interpreted as conciliatory overtures to U.S. policymakers. Nevertheless, South Korea's Ministry of Trade, Industry and Energy maintains plans to initiate WTO dispute consultations.

International countermeasures are emerging. Japanese Prime Minister Fumio Kishida has declared "all retaliatory options remain on the table," while Hyundai's $21 billion U.S. investment commitment fails to offset anticipated export declines from domestic plants. The Peterson Institute warns of potential "large-scale layoffs" across the automotive sector, with Japanese, Korean, and German automakers and suppliers facing disproportionate impacts due to their heavy reliance on the U.S. market.

Employment repercussions are already materializing. Canadian Prime Minister Justin Trudeau's establishment of a C$2 billion "Strategic Response Fund" underscores the crisis in North American supply chain disintegration. As noted by Professor Ignacio Martínez of the National Autonomous University of Mexico, while U.S. consumers ultimately bear the cost premium for vehicles produced in Mexican factories, immediate consequences will include plant closures and worker displacement.

Chinese auto companies are seeking a circuitous breakthrough

Global automakers are intensifying production realignment efforts. Hyundai's $5.4 billion U.S. investment plan exemplifies this trend, encompassing new EV plants and steel capacity expansion targeting over 70% localization. This "nearshoring" strategy has gained momentum, with the Trump administration touting such developments as validation of tariff policy effectiveness in manufacturing repatriation.

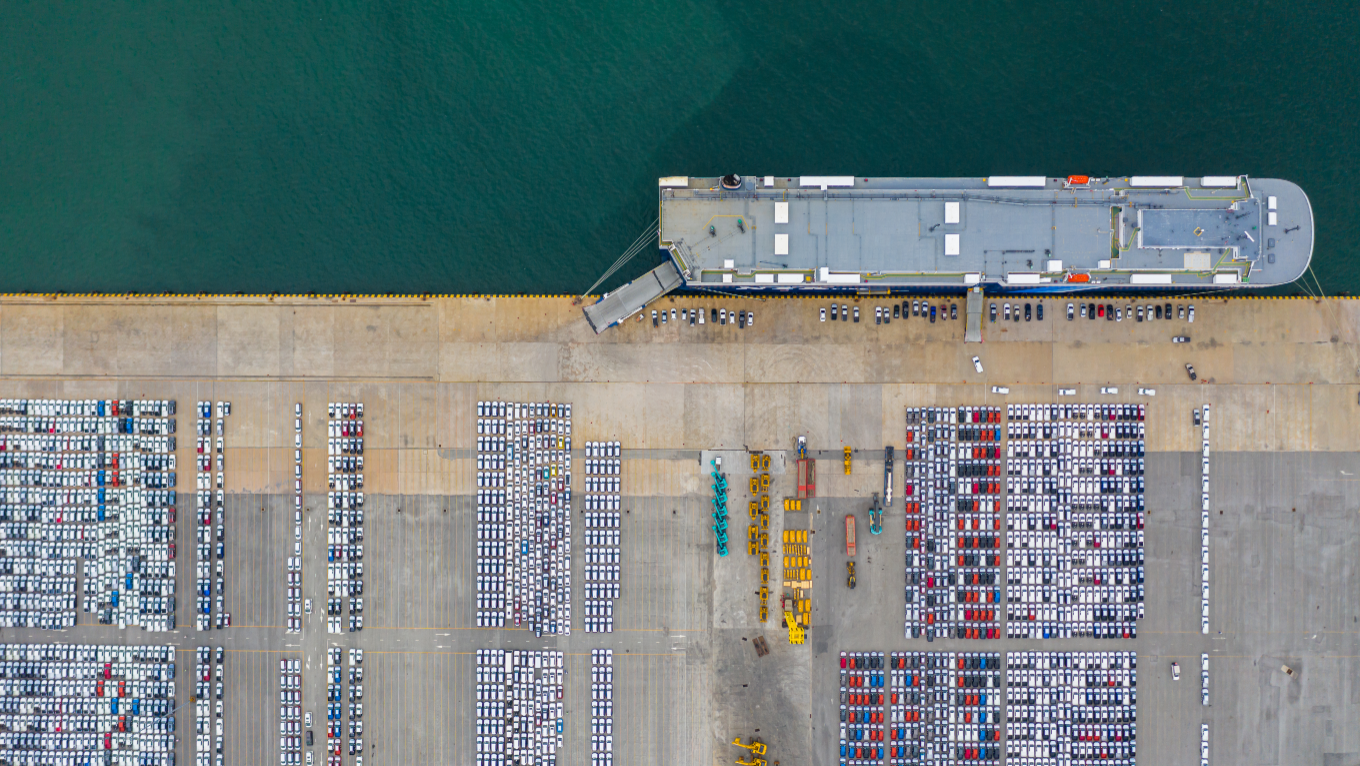

Nevertheless, Chinese manufacturers confront multifaceted challenges. Although direct exports to the U.S. remain limited, indirect export channels via Mexico face potential tariff barriers. For example, the projected 180,000 U.S.-bound vehicles assembled by Chinese automakers in Mexico during 2024 would incur 25% additional tariffs, substantially elevating costs. In response, companies like BYD and Great Wall Motors are accelerating factory construction in Southeast Asia and Europe while Chinese component suppliers explore tariff mitigation strategies through compliance with USMCA "American content" requirements.

Chinese automakers are implementing strategic countermeasures. SAIC Motor is expanding its European footprint with plans to establish an MG-branded production facility in Spain, while BYD prepares to construct its first European passenger vehicle assembly plant to circumvent EU anti-subsidy tariffs on Chinese EVs. Concurrently, technological collaborations are emerging as a key strategy: Leapmotor's partnership with Stellantis enables rapid overseas production deployment through existing facilities, marking the transition of China's automotive export model from pure trade to localized manufacturing.

However, supply chain restructuring presents formidable challenges. The American Automotive Policy Council emphasizes that the North American integrated supply chain, developed over decades, cannot be abruptly reconfigured without incurring permanent cost increases. For instance, while Ford and GM advocate localization, operational efficiency at their Mexican assembly plants would suffer severe degradation if component supplies were disrupted.

The Peterson Institute for International Economics projects that tariffs could increase average new vehicle prices in the U.S. by 3,500to3,500to10,000, potentially reducing car purchase demand among middle- and low-income groups by 25%. This impact proves particularly acute in the budget vehicle segment: Nearly all sub-$30,000 new vehicles rely on imports. Post-tariff implementation, automakers like GM and Ford may discontinue production of such models entirely, further constraining working-class purchasing options. Overall, price surges could depress U.S. auto sales by approximately 3 million units, representing nearly one-fifth of last year's total sales volume.

The U.S. automotive tariff policy functions as a double-edged sword: While ostensibly pursuing "national security" objectives to revitalize domestic manufacturing, it exacts substantial costs through heightened consumer burdens and deteriorating alliances. Although the forced restructuring of global supply chains may catalyze new industrial configurations, this transformation process jeopardizes millions of employment positions and global economic stability.

Under the new tariff policy, the impacts have proven extensive and complex - ranging from declining sales and employment risks for Japanese, Korean, and German automakers, through industrial chain relocations and strategic adjustments by Chinese manufacturers, to rising vehicle prices in the U.S. and escalating trade friction risks. Industry experts indicate that automakers will confront immediate challenges including increased costs, sales contraction, and shaken market confidence. In the long term, rather than achieving the envisioned "manufacturing renaissance," the policy risks fragmenting global supply chains, diverging technical standards, and escalating consumer costs, ultimately undermining the global competitiveness of the American automotive industry.

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission