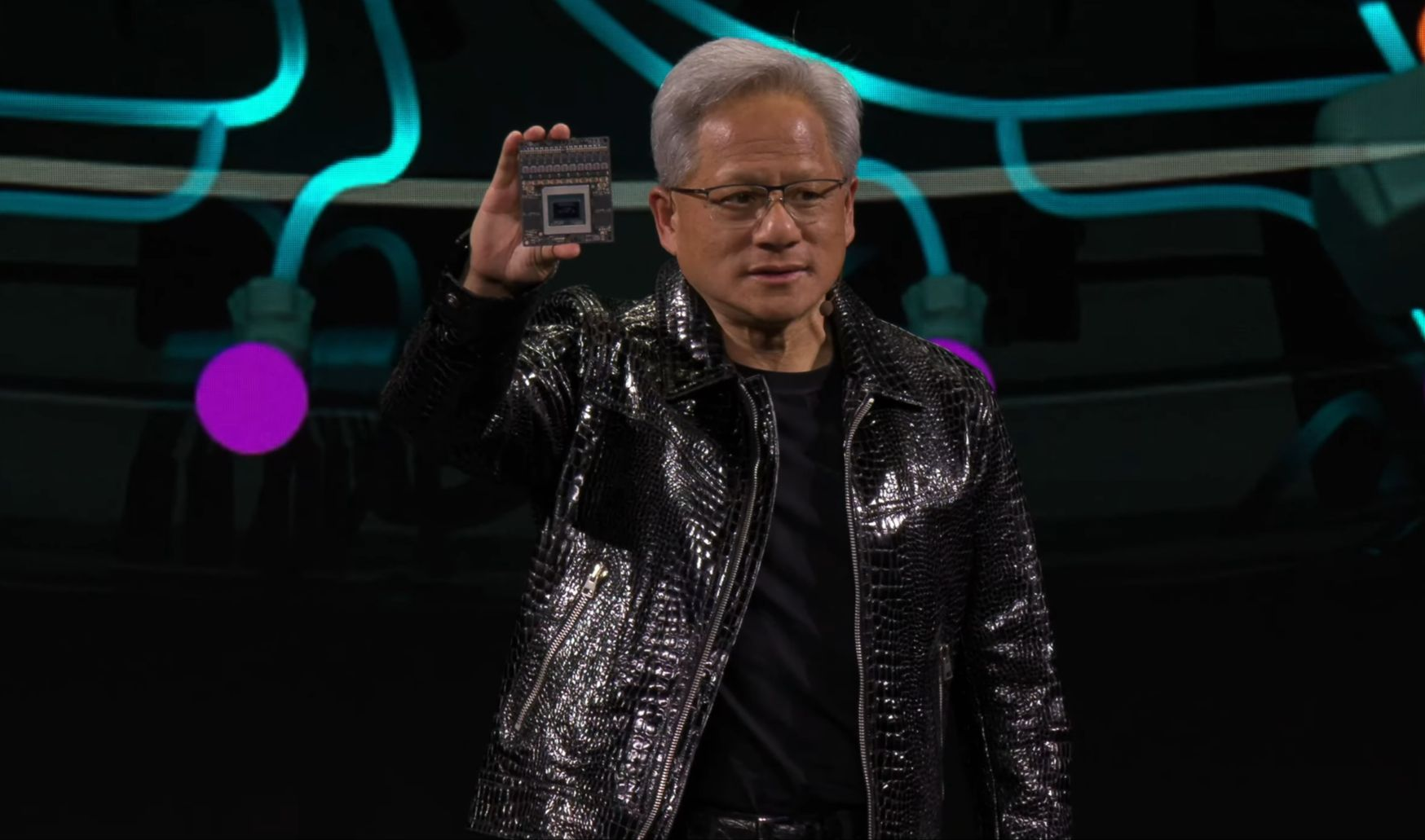

While NVIDIA’s Blackwell Ultra GB300 (288GB HBM3e, 15 PFLOPS FP4) dominates GTC headlines as an L4 enabler, a subtler battle for smart vehicle sovereignty escalates. This performance benchmark chip embodies both technological promise and the escalating tension between automakers and tech giants over industry control.

This computing revolution coincides with China’s "ADAS democratization" movement: Leapmotor’s ¥129k B10 with Qualcomm 8295, Huawei-GAC’s ¥140k lidar solutions, and Chery’s 2025 full-line ADAS commitment. As chip innovations drive L4 advancements, automakers must reconcile cost control, autonomy, and ecosystem dependencies.

The new chip defines the new TOPS

At GTC 2025, NVIDIA announced Blackwell Ultra GB300 mass production – 40x AI performance gains over Hopper architecture, featuring liquid-cooled automotive servers. Modular GPU design (user-replaceable slots) reduces upgrade costs while addressing thermal constraints, offering automakers flexible upgrade paths.

Software ecosystem consolidation strengthens NVIDIA’s leverage. The open-source Dynamo platform (dubbed "OS for AI factories") optimizes training-to-inference workflows, enabling OEM-specific algorithms. Full-stack capabilities (hardware+software+services) deepen partnerships like GM’s autonomous fleet collaboration and joint R&D with VanJee Tech in simulation/edge computing.

NVIDIA’s ecosystem expansion reveals strategic depth: The Blackwell Ultra GB300 chip achieves 500-ns multi-GPU latency via silicon photonics in NVIDIA Photonics platform. Li Auto’s MindVLA architecture leverages this for distributed computing – decoupling environmental modeling, trajectory planning, and risk prediction across units to bypass centralized architecture limitations.

The "open hardware + software-defined" paradigm reshapes market dynamics. NVIDIA’s Drive Orin-X dominated H1 2024 with 730k installations (35.9% share), while its Q4 FY2024 results (revenue $39.3B, +78% YoY; gross margin >70%) highlight growing automaker concerns about supply chain control.

Diversification strategies gain traction: automakers develop proprietary chips or multi-vendor solutions while training end-to-end models with real-world data to reduce hardware dependency. This reflects an industry-wide dilemma – balancing technological autonomy with development efficiency.

Supply chain integration and cost equalization are closely linked

Supply chain realignments emerge as countermeasures against NVIDIA’s dominance. BYD and Leapmotor demonstrate vertical integration and scale production as key weapons against monopolistic practices.

BYD’s "Celestial Eye" system exemplifies cost innovation – sub-¥5,000 hardware for highway NOA through sensor fusion (cameras, mmWave/ultrasonic radars) and algorithm refinement using 72 million kilometers of daily road test data. This data-driven approach accelerates ADAS penetration in ¥100k-200k models, targeting 60% adoption by 2025.

Collaborations reveal shifting dynamics: XPeng demanded open algorithm interfaces when co-developing NVIDIA’s DRIVE Thor platform. Leapmotor’s B10 leverages Qualcomm’s 8295 chip for multi-domain control via centralized architecture. Such partnerships enable automakers to negotiate chip pricing through bulk procurement while retaining software-defined vehicle leadership.

Breakthroughs like DeepSeek’s AI advancements could slash urban NOA hardware costs to ¥5,000 (from ¥9,000). Automakers reduce reliance on high-performance chips by optimizing decision-model energy efficiency (80% reduction), accelerating adoption of centralized domain controller architectures. This shift marginalizes premium components like lidar and HD maps in favor of lightweight solutions.

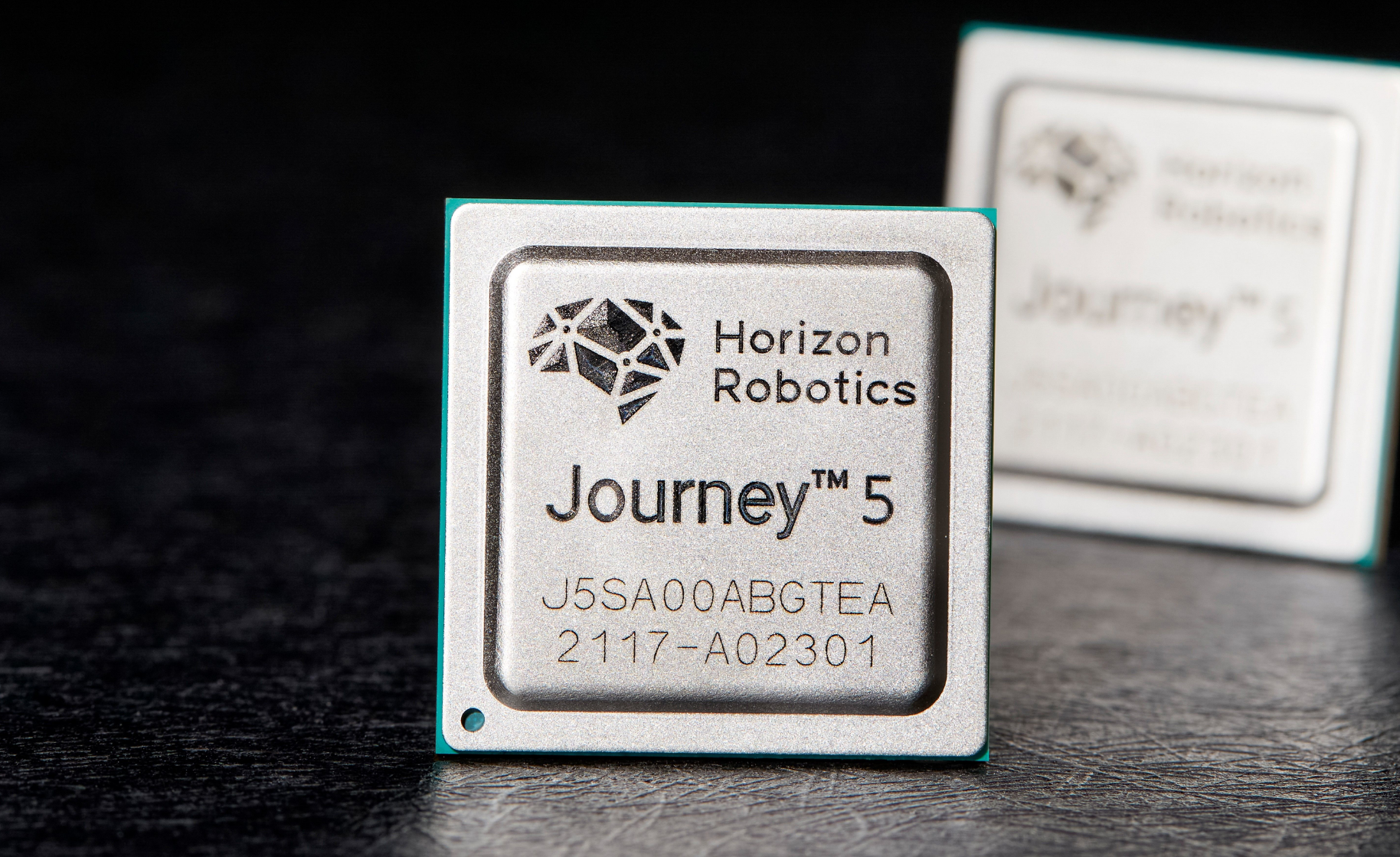

Amid NVIDIA and Qualcomm’s dominance, Chinese firms like Horizon Robotics and Black Sesame are making inroads. Horizon’s Journey 5 (96 TOPS) and Black Sesame’s A1000 Pro (106 TOPS) narrow the gap through scenario-specific optimizations: Horizon achieves low-power vision processing via chip-algorithm co-design, while Black Sesame combines AI computing with safety standards through heterogeneous architectures. Though limited to parking and highway navigation scenarios, these solutions demonstrate viable alternatives.

Amid NVIDIA and Qualcomm’s dominance, Chinese firms like Horizon Robotics and Black Sesame are making inroads. Horizon’s Journey 5 (96 TOPS) and Black Sesame’s A1000 Pro (106 TOPS) narrow the gap through scenario-specific optimizations: Horizon achieves low-power vision processing via chip-algorithm co-design, while Black Sesame combines AI computing with safety standards through heterogeneous architectures. Though limited to parking and highway navigation scenarios, these solutions demonstrate viable alternatives.

Technical barriers persist: NVIDIA’s CUDA ecosystem and trillion-parameter model training capabilities remain unmatched short-term, while domestic chips lag in automotive certification, toolchain maturity, and developer ecosystems. Automakers adopt dual-track strategies – deploying NVIDIA chips in premium models for performance while integrating domestic solutions in mid-range vehicles for cost efficiency.

The chip rivalry in smart vehicles reflects a power struggle over computing dominance and value redistribution across supply chains. NVIDIA leverages technological barriers to establish computing supremacy, automakers vie for control via supply chain integration and cost optimization, while domestic players carve out niche opportunities. As Level 4 autonomous driving approaches, this contest intensifies, with ultimate victory likely going to "chain masters" that combine core technological control with deep consumer insight.

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

Room 1104,Block B,JingBan Building,6 Middle Beisanhuan Road,Xicheng District,Beijing

(8610)62383600

(8610)62383600

quanqixiang@carresearch.cn

quanqixiang@carresearch.cn

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

京公网安备:11010202007638号|京ICP备17032593号-2|Report illegal and bad information:010-65993545-8019 jubao@carresearch.com

Legal support:Beijing Yingke Law Firm|All rights reserved, DO NOT reproduce without permission